D2 Finance is a decentralized multi strategy derivatives protocol designed to offer institutional grade managed strategies within the crypto ecosystem. Built with a focus on scalable, sustainable yield, the protocol combines over two years of applied DeFi experience with five years of traditional finance expertise. Its goal is to deliver risk adjusted returns through diversified strategies powered by options and derivatives.

Operating natively on the HyperEVM, the Ethereum compatible virtual machine integrated with Hyperliquid, D2 Finance enables users to access sophisticated yield strategies with a simple one click experience. Unlike forked or simplified protocols, D2 Finance emphasizes custom architecture and direct integration with HyperCore using its audited CoreWriter module. This ensures deep liquidity, fast execution and a seamless trading environment similar to centralized exchanges but with the transparency of DeFi.

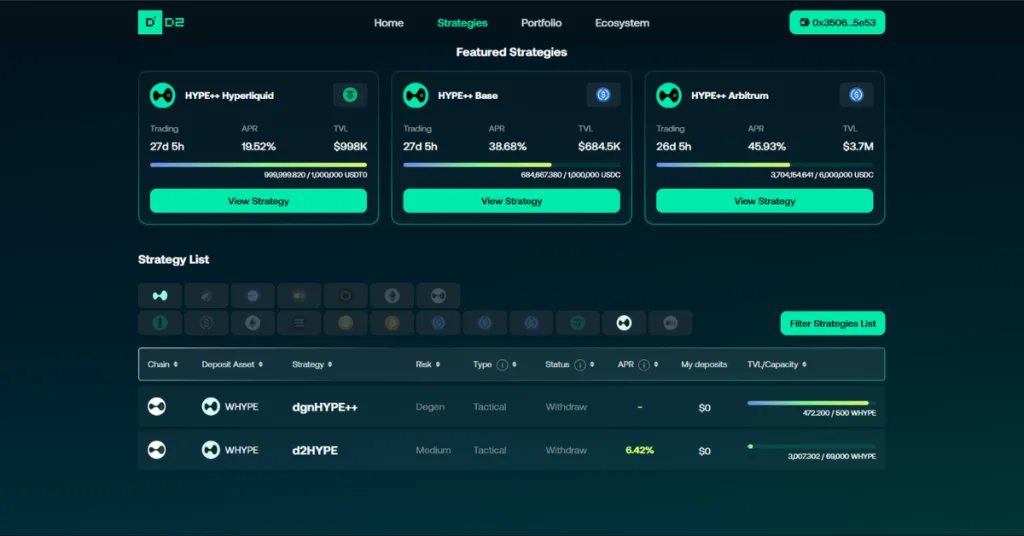

With over 10 million dollars in total value locked and proven on chain performance, the protocol positions itself as a decentralized software platform hosting strategy vaults. The trading engine itself is provided by an external party, meaning D2 Finance does not function as an investment firm but rather as a transparent, composable yield infrastructure.

What Is D2 Finance?

D2 Finance is a DeFi vaults platform built on options based strategies, serving the native ETH community and users seeking actively managed crypto strategies. It allows users to deposit stablecoins such as USDC into vaults that execute derivative based strategies aimed at earning yield across stablecoins, Bitcoin and real world assets. The tight integration with the HyperEVM allows D2 to leverage deep liquidity and the high performance infrastructure of Hyperliquid.

At its core, D2 Finance is more than a multi strategy fund. It is a liquidity abstraction engine that converts HyperCore’s deep liquidity into a building block for advanced user strategies. Through precompiled contracts, the protocol enables trading of perpetual futures directly from the EVM, maintaining full non custodial execution and on chain transparency.

Strategically, the protocol spreads risk across volatility based strategies, event driven delta neutral structures, BTC convexity setups and fixed income exposures through RWAs. Everything is executed on chain without layers of hidden wrappers or opaque mechanisms.

Integration With the HyperEVM and Hyperliquid

The integration between D2 Finance and the HyperEVM represents a major step forward for decentralized derivatives. Hyperliquid operates as a high performance Layer 1 optimized for perpetual futures, and the HyperEVM provides full EVM compatibility directly inside this environment.

Through Hyperliquid’s native precompiled contracts, D2 Finance can:

- Trade perpetual futures directly from smart contracts

- Maintain non custodial architecture while using deep liquidity

- Read and write to HyperCore’s order book in real time

- Execute complex hedged strategies at low latency

- Scale yield sources across multiple chains

The HyperEVM eliminates the need for bridges, proofs or trusted signers, allowing seamless cross component composability inside Hyperliquid. Consensus is secured via HyperBFT, creating a unified environment for perpetual trading, funding arbitrage vaults and other yield based strategies.

This design results in significantly improved capital efficiency and elevates D2 Finance far beyond typical forks or liquidity wrappers.

Strategies Offered by D2 Finance

D2 Finance deploys a wide set of risk adjusted strategies categorized across three main areas: stablecoins, Bitcoin and RWAs.

Stablecoin Strategies

These strategies revolve around delta neutral positioning, funding arbitrage and liquidity incentive mechanisms. They combine multiple sources of alpha to generate stable yield independent of market direction.

Bitcoin Strategies

For BTC, the protocol uses convexity based structures, volatility strategies, momentum and option baskets. This provides exposure to Bitcoin while generating consistent yield through derivatives modeling.

RWA Strategies

D2 Finance also targets macro yield opportunities through tokenized real world assets and TradFi style volatility trading. These strategies aim to deliver fixed income like returns without relying on private credit exposure.

Examples of notable strategies include:

- HYPE++ – An institutional alpha overlay on Ethereum with upside exposure to Hyperliquid

- iARB, ARB++ and d2USDC – Relative value volatility arbitrage vaults

- d2HYPE – A strategy built around Hyperliquid’s ecosystem interactions

The protocol expects annualized trading volumes to surpass 1 billion dollars as it scales across Derive, GMX, Exponents_Fi and the broader Hyperliquid liquidity ecosystem.

How the Protocol Works

The D2 Finance vault system operates in structured epochs divided into phases for funding, trading and withdrawal. Users deposit assets such as USDC, USDT or USDe into vaults, and the protocol manages all trading through an external but audited engine integrated with the D2 OMS.

During trading phases, the strategy executes hedged and diversified positions by reading prices directly from the HyperCore order book and submitting orders through precompiled write functions. Liquidations follow HyperCore’s perpetual model, ensuring reliable protocol level enforcement.

The vaults are also deployed as OFT (Omnichain Fungible Tokens) using Layer Zero, enabling unified PnL across multiple chains. Deposits are supported on:

- USDT0 (HyperEVM)

- USDe (Ethereum mainnet)

- USDC (Arbitrum)

Automatic rebalancing ensures no manual intervention is required, and historical performance has shown over 140 percent cumulative returns between December 2023 and April 2025.

Risks to Consider

Despite its strong security posture, D2 Finance carries inherent risks associated with any DeFi protocol.

These include:

- Smart contract vulnerabilities

- Market volatility affecting underlying assets

- Funding arbitrage failure during extreme conditions

- Cross chain latency and settlement delays

- Regulatory shifts in the US and other jurisdictions

- HyperEVM still being in alpha phase

Users should always perform their own research and set expectations based on risk tolerance and capital size.

How to Farm the D2 Finance Airdrop

Although D2 Finance does not have a confirmed airdrop, it remains one of the best ways to farm rewards across the HyperEVM ecosystem and beyond. Its vaults automatically interact with multiple protocols, collecting points, yield and third party rewards along the way.

For example, vaults like d2HYPE and HYPE++ interact daily with major HyperEVM protocols such as:

- HyperLend

- Felix

- HypurrFi

- HyperDrive

- Kinetiq

These interactions generate activity and points that may qualify users for potential Hyperliquid or Base related airdrops.

It works essentially as an automatic farming system. You deposit once, and the vault performs all the interactions, hedging and swaps for you without needing to manually track or manage positions.

Summary

- Choose your preferred D2 Finance vault

- Deposit USDC, USDT or USDe depending on availability

- Let the vault execute strategies and generate yield

- Accumulate potential airdrop eligibility across multiple protocols

This makes D2 Finance an attractive tool for passive farmers seeking exposure to the HyperEVM ecosystem.

This is one of the simplest forms of airdrop farming available today. You deposit once, earn yield and simultaneously gain exposure to multiple potential airdrop campaigns. Still, users with smaller capital should temper expectations. As with most yield aggregators and strategy vaults, whales benefit the most due to compounding effects and the proportional nature of rewards.

Even so, for passive farming and ecosystem exposure, D2 Finance remains one of the strongest options on the HyperEVM.

🔗Links

D2 Finance: Official Website

D2 Finance Documentation: Docs

Disclaimer

This is not financial advice. If you decide to interact with the mentioned protocols, you do so at your own risk. Airdrop Guild is not responsible for any potential losses resulting from participation. Always do your own research before engaging with blockchain based projects.