NX Finance is an innovative DeFi protocol built on the Solana blockchain, designed to function as a yield layer within the ecosystem. Launched in Q2 2024, NX Finance stands out as Solana’s first composable leverage protocol that integrates yield aggregation and PointFI (points for decentralized finance participation). Its main goal is to allow users to maximize returns through leveraged yield strategies and point farming, filling a gap in Solana’s DeFi landscape by providing adaptive financial products capable of redistributing risk from high uncertainty assets.

With approximately 3.27 million dollars in total value locked, NX Finance operates exclusively on Solana and enables investors to optimize returns in a low cost, high speed environment. Through composability, the protocol allows users to combine different DeFi components to build personalized strategies, ranging from conservative to highly aggressive. By focusing on premium yield bearing assets and seasonal points campaigns, NX Finance amplifies both yield and reward potential while encouraging deeper participation across Solana.

How NX Finance Works

NX Finance operates as a yield layer that generates returns through premium interest bearing assets and point farming campaigns. The core mechanism is built around yield stratification, which redistributes risk from high uncertainty assets into tailored products that match different investor profiles.

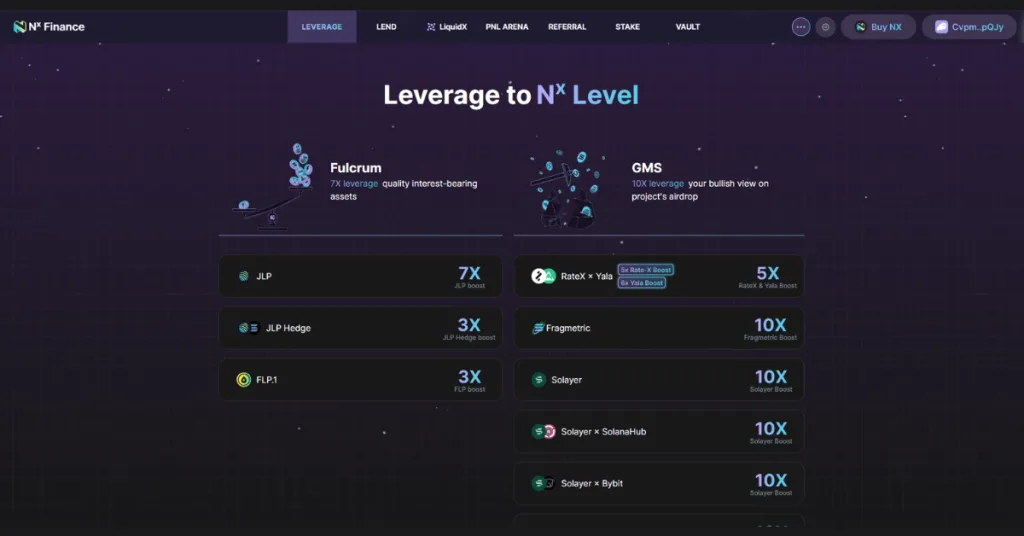

Users can deposit assets such as SOL or USDC to earn extra yield with built in principal protection, all without active management. The protocol’s leverage engine enables users to amplify yield and points by up to 10 times. This is achieved through leveraged positions on assets like JLP (Jupiter Liquidity Provider tokens), which are widely used within Solana’s DeFi ecosystem for providing liquidity to decentralized exchanges.

Bullish users can express directional market views using leveraged positions, maximizing potential returns without needing to manage complex strategies. Meanwhile, lenders earn passive yield with minimal risk due to collateralization mechanisms that protect the deposited principal.

NX Finance also integrates PointFI, enabling leveraged point farming of up to 10x during airdrop and campaign seasons. This makes the protocol highly effective for users who target airdrops from popular Solana projects such as Jupiter or any protocol running seasonal point emissions.

By combining yield bearing assets, leveraged products and points farming into a modular and decentralized architecture, NX Finance provides one of the most flexible and efficient yield frameworks in the Solana ecosystem.

Key Features

NX Finance introduces several standout features that make the protocol uniquely competitive in Solana DeFi:

10x Leveraged Yield on Premium Assets

Users can amplify yields by up to ten times on interest bearing assets. This drastically increases return potential without requiring complex manual management.

10x Leveraged Points for Airdrop Farmers

Point farming is central to modern DeFi, and NX Finance allows users to magnify point accumulation—ideal for maximizing rewards in upcoming airdrops.

Principal Protected Lending

Lenders can deposit USDC, USDT or SOL and receive extra yield while maintaining principal protection through collateralized systems.

Bullish Leverage on Solana

The protocol is the only one on Solana currently offering leveraged bullish positions, enabling users to scale exposure efficiently.

Composable Strategy Layer

By layering yields, leverage and points, NX Finance offers strategies that vary from conservative income based products to aggressive high exposure plays.

Innovations and Differentiators

NX Finance introduces several innovations that distinguish it from traditional DeFi protocols:

- Composable and Modular Design: Allows users to combine yield, leverage and points to build custom financial strategies.

- Risk Redistribution: Stratifies high risk assets and redistributes yield opportunities according to user profile.

- PointFI Integration: NX Finance is one of the first protocols to allow extreme point leverage within seasonal airdrop campaigns.

- Focus on Sustainable Tokenomics: Inspired by successful Solana projects like Jupiter, the protocol emphasizes long term sustainability over inflated TVL metrics.

- Principal Protection: Reduces risk for conservative users while enabling aggressive strategies for risk tolerant investors.

NX Finance also aims to solve a market gap by offering adaptive yield products that adjust to different user needs, improving accessibility across Solana DeFi.

Vision and Future Outlook

NX Finance aims to become the central yield and leverage hub on Solana. Its long term goal is to unify yield strategies, point campaigns and leveraged products into a single ecosystem where users can easily deploy capital based on their risk preferences.

The team plans to expand with:

- Additional seasonal point campaigns

- NX V2

- Integrations such as LiquidX for DLMM based leveraged liquidity

- Expanded partnerships with major Solana protocols

Despite facing typical early stage challenges—especially around token launches—the protocol’s roadmap and community driven governance demonstrate strong potential for long term growth.

How to Farm the NX Finance Airdrop (Season 3)

Season 3 of NX Finance has already begun and focuses heavily on points farming for future token distributions. Community governance determines point weights and allocations, forming an essential part of the $NX tokenomics.

A total of 51 percent of the $NX token supply is reserved for seasonal point incentives, making participation extremely valuable for farmers.

Below is the step by step guide to farming the airdrop.

Step by Step: How to Farm the NX Finance Airdrop

1. Connect Your SVM Wallet

Backpack Wallet is recommended because it gives a 10 percent points boost.

2. Go to the Airdrop Tab

Enter the team using the invite code AirdropGuild to join the official Airdrop Guild squad.

3. Explore NX Finance Products to Earn Points

NX Finance offers several ways to accumulate points:

Leverage

Use leveraged strategies on assets like JLP, where up to 7x leverage is currently available by borrowing USDC or USDT.

Be mindful of liquidation thresholds and asset volatility.

Lend

Deposit assets such as USDC, USDT or SOL to earn passive APR with principal protection.

LiquidX

Provide leveraged liquidity in either long or short mode using DLMM based liquidity pools.

Stake

Stake NX tokens to earn additional APR and strengthen protocol governance participation.

Vaults in Partnership With Drift

Earn attractive APR through joint vault strategies built with Drift Protocol.

You accumulate points automatically through these interactions, increasing your eligibility for future rewards.

NX Finance offers a wide variety of yield opportunities on Solana, making it attractive for both airdrop farmers and yield seekers. Its combination of leveraged yield, PointFI, lending, DLMM liquidity and sustainable tokenomics positions it as one of the most versatile protocols in the ecosystem.

For users looking to maximize potential rewards while also benefiting from passive or leveraged income, NX Finance provides a powerful set of tools. As always, farmers should remain aware of risks and choose strategies that align with their capital size and risk tolerance.

🔗Links

NX Finance: Official Website

NX Finance Documentation: Docs

Disclaimer

This is not financial advice. If you decide to interact with the mentioned protocols, you do so at your own risk. Airdrop Guild is not responsible for any potential losses resulting from participation. Always do your own research before engaging with blockchain based projects.