What is Hyperliquid?

Hyperliquid is a high-performance Layer 1 blockchain built specifically for DeFi applications, with a strong emphasis on perpetual derivatives trading. Launched in 2023, it quickly stood out for its technical capacity, supporting up to 100,000 orders per second and block finality in under one second, thanks to its proprietary HyperBFT consensus mechanism, a customized Proof-of-Stake model.

The platform’s flagship product is its on-chain order book exchange, an uncommon feature in the world of DEXs, which typically rely on automated market makers (AMMs). This architecture provides superior transparency, speed, and fee efficiency, as users enjoy zero gas fees for most operations. Hyperliquid also supports spot trading, and with the launch of its HyperEVM, it now accommodates smart contracts and a broader ecosystem of DeFi dApps.

*Advertisement.*

As the ecosystem expands, integrations with major chains like Ethereum, Bitcoin, and Solana are already in place. However, the platform has also faced some challenges, including a publicized controversy in March 2025 involving market manipulation around the JELLY token, which temporarily shook confidence and affected the price of its native token HYPE.

Despite this, Hyperliquid remains one of the most promising DeFi infrastructures in development, backed by strong funding and a rapidly evolving ecosystem.

Review of the First Airdrop

The first Hyperliquid airdrop was highly successful, distributing 310 million HYPE tokens, or 31% of its total supply, to over 90,000 eligible users. Participants earned points, primarily by trading perpetuals and spot markets.

On average, users received between 2,881 and 2,915 HYPE tokens, which at the peak price of $9.80–$12.00 translated to rewards worth $28,000 to $34,000.

The campaign gained significant traction, attracting thousands of traders and a wave of new users. And even for those who missed the first opportunity, there’s still more to come: 38.88% of the token supply—388.88 million HYPE—was reserved for future emissions and community rewards. This suggests that Hyperliquid will continue to incentivize usage through new rounds of airdrops or point-based programs.

How to Farm the Next Hyperliquid Airdrop

There are two primary ways to increase your chances of qualifying for the next airdrop:

- Using the main Hyperliquid protocol

- Interacting with dApps in the HyperEVM ecosystem

Let’s break down each of these.

Farming Through the Core Protocol

Start by depositing assets into the platform. You can use Arbitrum, Bitcoin, or Ethereum. Many users prefer Arbitrum due to its low fees and seamless compatibility. The amount you deposit is up to you, but as always, higher value deposits lead to greater volume and potentially higher airdrop eligibility.

Once funded, here are the main activities to focus on:

- Vaults (HLP): You can deposit into the HLP vault to earn rewards. Keep in mind that assets deposited here are locked for a few days, so this strategy requires a bit of patience.

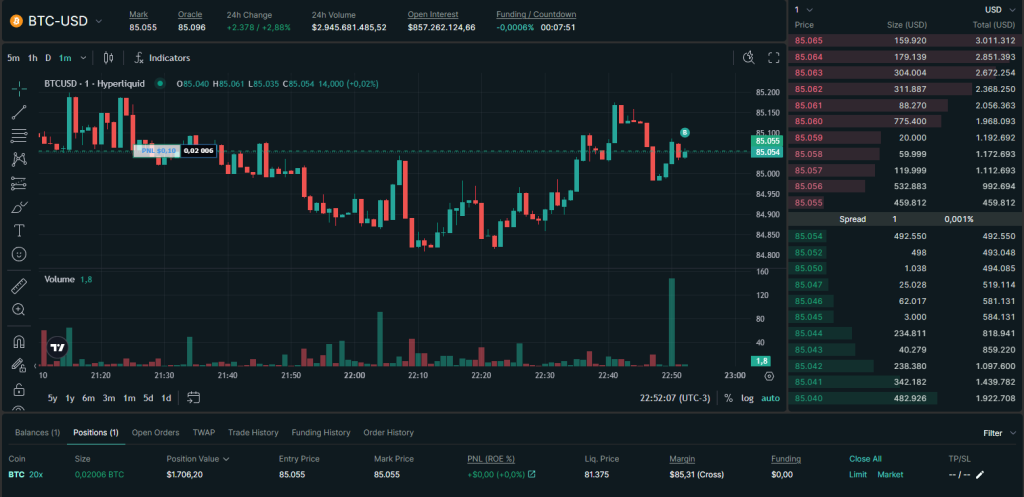

- Perpetuals (Perps): Trade long or short positions with leverage. It’s recommended to use low leverage if you’re not experienced, as liquidation risk grows quickly with high leverage. Keeping your positions open for hours or days may also help build stronger on-chain history, which could be relevant for eligibility.

- Spot Market + Staking: You can use the “Perps Spot Transfer” function to move funds from your perpetuals account to your spot account. From there, you can purchase tokens like HYPE and stake them on the platform. This adds another layer of interaction and could boost your airdrop chances.

Exploring HyperEVM

Once you acquire HYPE tokens, you can transfer them to HyperEVM via the “Transfer to EVM” function found under Balances. This opens the door to multiple dApps that are part of Hyperliquid’s growing ecosystem.

Here are the top protocols to explore:

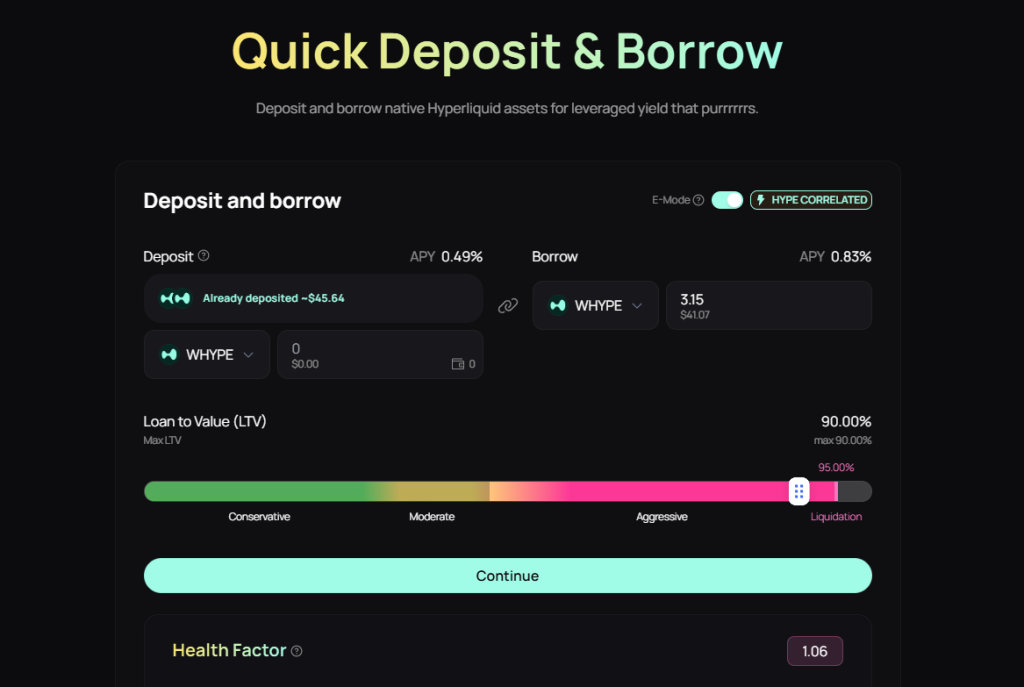

HypurrFi

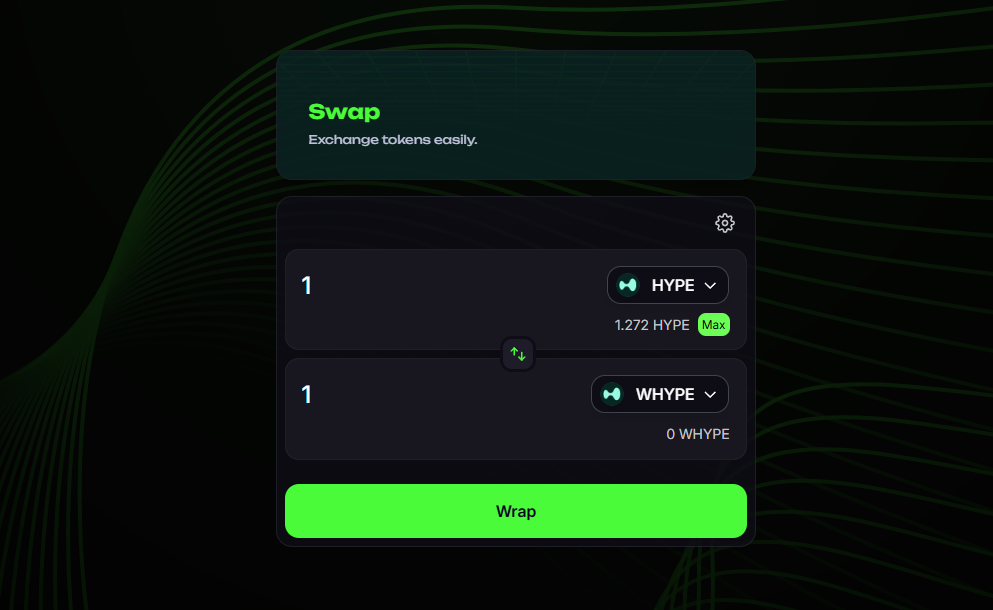

A borrow/lend protocol. You can deposit HYPE, borrow WHYPE, and even use your position to engage with other dApps. Use the E-Mode setting to borrow against correlated assets and minimize risk of liquidation. After borrowing, you can swap the borrowed WHYPE back to HYPE within the same ecosystem, making this a capital-efficient loop.

HyperSwap

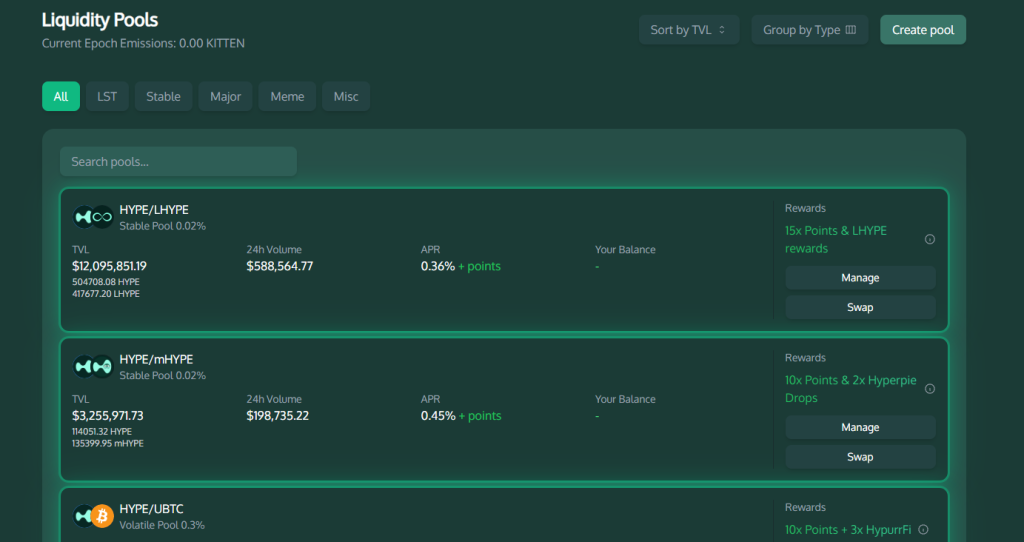

This DEX allows for token swaps and liquidity provision. You can set up a liquidity pool and earn additional points and rewards, all while interacting with key infrastructure components.

*Advertisement.*

Kittenswap

A fun and active DEX where you can also provide liquidity. A great strategy here is to provide liquidity to the HYPE/LHYPE pair, which minimizes impermanent loss since both assets are closely correlated. You can also earn protocol incentives by staking LP tokens.

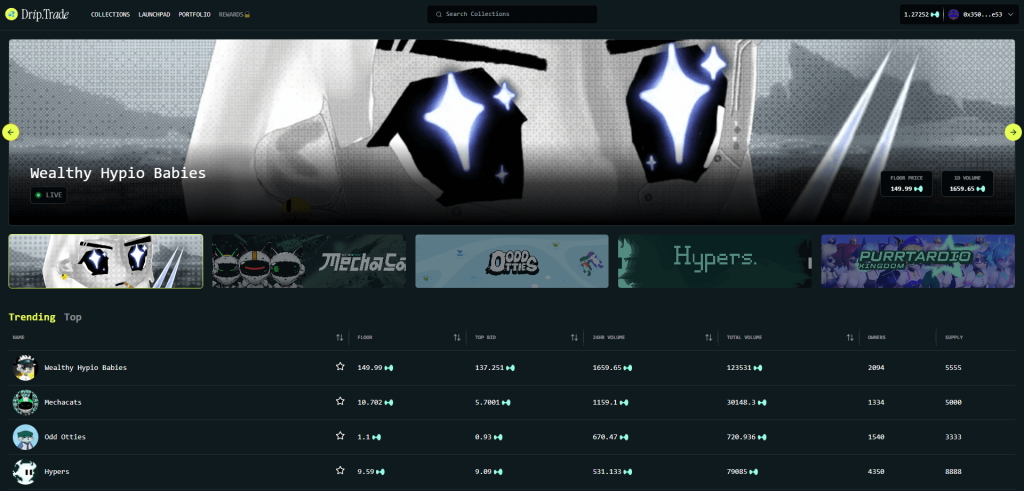

Drip Trade

This is the NFT hub of the HyperEVM. You can buy and sell NFTs to generate volume and potentially unlock ecosystem-based rewards. Some collections, like Mechacats and Hypers, even offer extra point multipliers in associated DeFi protocols such as Kittenswap and Hyper Swap.

Best Practices for Maximizing Airdrop Eligibility

- Maintain consistent activity: Interact with both the main protocol and HyperEVM regularly.

- Diversify your actions: Don’t just farm one feature. Stake, trade, lend, provide liquidity, and buy NFTs.

- Stay up-to-date: Join the Hyperliquid Discord and follow updates on social media to be the first to know about snapshots, campaigns, or new eligible features.

- Avoid Sybil behavior: Use your main wallet and keep activity organic. Overusing multiple wallets could lead to disqualification.

Final Thoughts

The Hyperliquid ecosystem has grown rapidly, and its next airdrop could be just as valuable as the first. With nearly 39% of the supply reserved for the community, there are still plenty of incentives on the horizon.

By staying engaged, diversifying your interactions, and being active on both Hyperliquid and HyperEVM, you’re putting yourself in an excellent position to capitalize on the platform’s future growth.

Whether you’re a DeFi power user or a newcomer, this is one of the most promising opportunities currently available for meaningful airdrop farming.

Watch our video:

Disclaimer

This is not financial advice. If you decide to interact with the mentioned protocols, you do so at your own risk. Airdrop Guild is not responsible for any potential losses resulting from participation. Always conduct your own research before engaging with blockchain projects.