Block Street is a DeFi protocol specialized in tokenized assets, focusing primarily on tokenized stocks such as AAPL, TSLA, MSFT, NVDA, COIN, and MSTR.

It serves as a unified liquidity layer for real-world assets (RWAs), enabling users to trade, lend, and borrow tokenized stocks efficiently, with isolated risk pools, cross-leverage, and optimized yields — all managed directly on the blockchain.

Main Objective

The mission of Block Street is to bridge TradFi (Traditional Finance) with DeFi, allowing real-world financial instruments like stocks to exist and operate natively on-chain.

Here’s what makes the project stand out:

- TradFi + DeFi Connection:

Block Street tokenizes real-world equities and allows users to trade, lend, and use them as collateral without intermediaries like brokers or banks. - Superior Efficiency:

Offers up to 4× higher leverage with lower interest rates, achieved through dynamic rate optimization and overcollateralized lending models. - Cross-Asset Leverage:

Users can borrow against one tokenized stock (like AAPL) to buy another (like TSLA), all within a unified liquidity layer — creating new possibilities for on-chain portfolio management.

Core Technology Components

Block Street is powered by two primary engines that work together to deliver liquidity and risk management:

AQUA (Aggregation Layer)

- Smart Liquidity Aggregator: Gathers real-time price data from multiple issuers and markets to ensure the best possible execution.

- RFQ Intents (Request for Quote): Enables quotes from different market makers who compete to provide the best price.

- Hybrid Security: Combines off-chain matching with on-chain settlement for both speed and verifiability.

In short, AQUA acts as the liquidity discovery layer, ensuring efficient trading between tokenized assets across various sources.

EVERST Protocol (Lending and Liquidation Engine)

- Core Lending Layer: Manages the lending, borrowing, and liquidation mechanisms for tokenized assets.

- Supply: Users can deposit tokenized stocks or stablecoins to earn dynamic yield.

- Borrow: Enables overcollateralized loans (150–200%) with up to 4× cross-leverage.

- Liquidations: Executes through hybrid auctions (off-chain) and instant on-chain settlements with sub-second finality.

- Isolation: Each pool is isolated per asset to prevent contagion between markets (for example, an AAPL crash doesn’t affect TSLA loans).

The combination of AQUA and EVERST creates a two-engine architecture:

Tokenized Stocks → AQUA (Execution) ↔ EVERST (Lending) → Yields & Leverage

Blockchain and Launch Plan

- Mainnet: Scheduled for Q4 2025 on Monad, a high-performance EVM-compatible chain.

- Other Supported Networks: BNB Chain and select Layer-2s.

Block Street’s hybrid design makes it chain-agnostic, focusing on performance, interoperability, and global liquidity aggregation.

Funding and Partnerships

- Total Funding: $11.5 million (October 2025)

- Led by: Hack VC

- Other Investors:DWF Labs, Generative Ventures, StudioB, Bridge34

- These groups have ties to Jane Street, Point72, and Hudson River Trading (HRT) — major names in quantitative finance.

Strategic Partnerships:

- Timestamping Alliance

- HodlHer AI

- aPriori

- Monad Eco

Key Features Overview

| Feature | Description | Benefit |

|---|---|---|

| Swap | Trade tokenized assets (e.g., AAPL → BSD) | Instant liquidity |

| Supply | Provide assets as collateral | Earn yield |

| Borrow | Borrow with overcollateralized positions | Leverage and capital efficiency |

Block Street enables seamless trading, lending, and borrowing — all centered around tokenized stocks, combining DeFi performance with TradFi familiarity.

How It Solves Liquidity Fragmentation

One of the biggest challenges in the RWA sector is liquidity fragmentation — with different issuers like Backpack, Kraken, and Coinbase each offering isolated tokenized markets.

Block Street solves this by creating a unified liquidity pool that aggregates data and liquidity across these venues.

This unified model boosts efficiency and price accuracy while reducing slippage and spreads.

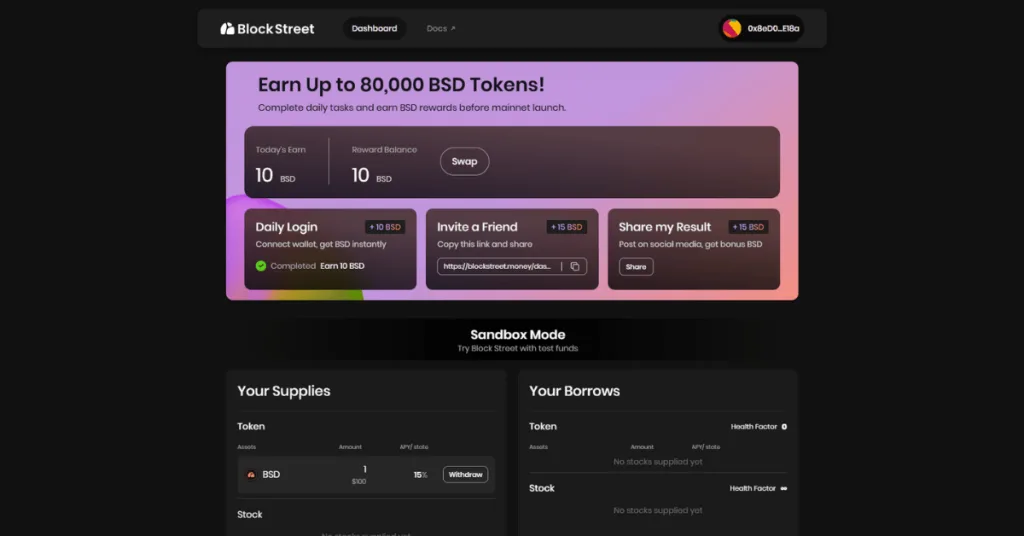

How to Farm the Block Street Airdrop

Block Street currently has an active and completely free farming campaign, allowing anyone to collect BSD tokens daily.

These BSD tokens are used for protocol interactions such as swaps, lending (supply), and borrowing.

Step 1 — Connect Your Wallet

- Go to the official Block Street app.

- Connect your crypto wallet (EVM-compatible, such as MetaMask or Rabby).

- You’ll be asked to verify your email address to complete the registration.

- Once verified, you’ll automatically receive 10 BSD as a welcome reward.

Step 2 — Start Interacting With the Protocol

Use the BSD you received to interact with the platform.

There are three main actions you can perform:

1. Swap

- Exchange tokenized assets (for example, AAPL → TSLA or AAPL → BSD).

- This simulates real trading activity and helps you build transaction history on-chain.

2. Supply

- Provide tokenized assets as collateral within the EVERST module.

- You’ll earn dynamic yields and establish yourself as a liquidity provider — an important metric for airdrop eligibility.

3. Borrow

- Use your supplied assets as collateral to borrow other tokenized assets or BSD.

- Borrowing expands your liquidity exposure and activity score within the protocol.

Each interaction strengthens your on-chain footprint and increases your farming weight for future snapshots.

Step 3 — Invite Friends and Share Results

- Invite new users using your referral link — you’ll earn 15 BSD per invite.

- Share your results or stats on X (Twitter) — every verified post gives you an additional 15 BSD.

This simple engagement loop rewards active participants and content creators while boosting the project’s visibility.

Step 4 — Increase Liquidity Over Time

As you accumulate more BSD through interactions, referrals, and posts:

- Reinvest it into Swaps, Supply, or Borrow actions.

- The more volume and transactions you perform, the stronger your on-chain engagement becomes — which will likely be considered in the upcoming airdrop distribution.

Why This Airdrop Is Worth Your Time

The Block Street airdrop is straightforward, requires no initial investment, and can easily fit into a daily farming routine that takes just a few minutes per day.

Here’s why it’s worth adding to your farming list:

- It’s free — you only need a wallet and a few minutes of interaction.

- It’s RWA-focused, a sector with massive growth potential in 2025.

- It’s backed by serious investors with TradFi experience.

- It has a clear product architecture (AQUA + EVERST) already in public testnet.

By merging tokenized stocks and DeFi lending, Block Street is one of the most promising projects in the RWA narrative — and early farmers are positioning themselves perfectly for the future airdrop.

🔗Links

Block Street: Official Website

Block Street Documentation: Docs

Disclaimer

This is not financial advice. If you decide to interact with the mentioned protocols, you do so at your own risk. Airdrop Guild is not responsible for any potential losses resulting from participation. Always do your own research before engaging with blockchain-based projects.