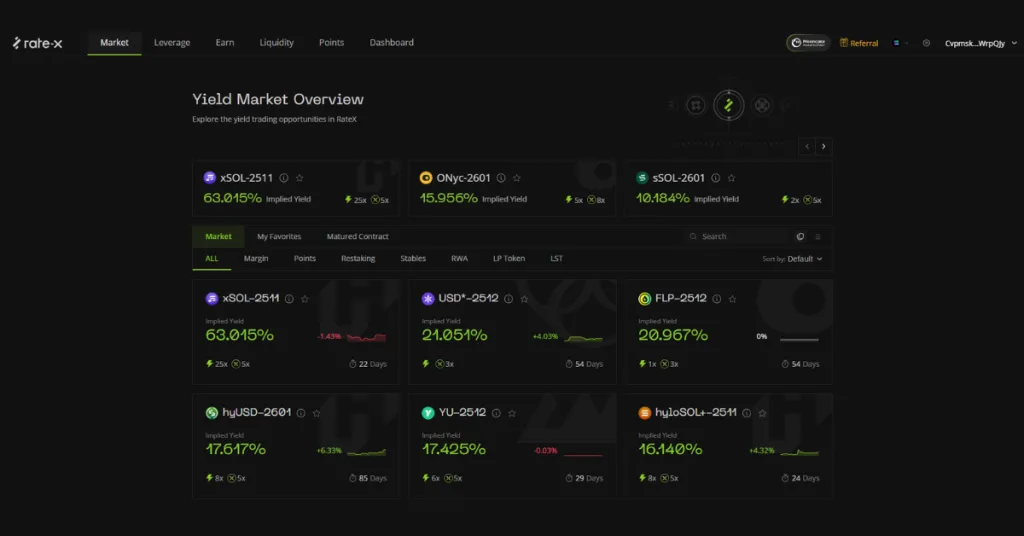

RateX is a decentralized exchange (DEX) built primarily on the Solana blockchain, specialized in leveraged yield trading, yield tokenization, and principal–yield separation.

Launched as the leveraged yield exchange, RateX revolutionizes the DeFi ecosystem by allowing users to trade uncertain future yields as speculative assets — transforming what was once passive yield farming into an active and strategic trading opportunity.

In essence, RateX bridges the gap between yield farming and margin trading, giving investors tools to go long or short on yields of underlying DeFi assets (such as staking or liquidity tokens) without needing to hold those assets directly.

How RateX Works

Multi-Chain Design with Solana as the Core

RateX operates across EVM blockchain but has its strongest presence on Solana, leveraging its high throughput, low fees, and near-instant finality to efficiently process complex transactions.

The protocol introduces a new type of derivative system called Synthetic Yield Tokens (YTs), which represent the right to the future yield of an income-generating asset.

For example, when users deposit a yield-bearing asset (like JitoSOL or Kamino LP tokens):

- Yield Tokens (YT): representing the variable future yield.

This separation allows users to:

- Sell their YT to lock in a fixed yield upfront.

- Buy YT with leverage to speculate on rising yields in volatile markets.

It’s a flexible and innovative model that makes yield markets tradable, liquid, and dynamic.

Standard Tokens (ST)

Another key feature of RateX is its Standard Token (ST) system, which uses a rebasing mechanism to automatically adjust token supply or value according to the underlying yield performance.

This ensures that each ST continuously reflects real yield accumulation, providing a transparent, automated representation of yield-bearing assets — crucial in volatile DeFi environments where APYs fluctuate due to liquidity shifts or market demand.

Fixed Yield Farming

For more conservative users, RateX offers fixed-yield pools.

Depositors can stake yield-bearing tokens and receive predictable fixed returns, effectively offloading yield volatility to speculative traders.

This creates a balanced ecosystem:

- Conservative LPs earn stable income.

- Speculative traders assume market risk and potential upside.

By providing this dual structure, RateX transforms yield farming into a two-sided marketplace, where both stability and speculation coexist efficiently.

Innovation and Position in DeFi

RateX can be seen as an evolution of protocols like Pendle, but with a clear focus on leverage and composability within Solana’s ecosystem.

Its design addresses long-standing challenges in DeFi:

- The unpredictability of APYs,

- The lack of hedging instruments for yield volatility, and

- The limited capital efficiency of traditional yield farming.

During market volatility — for instance, when staking yields spike or drop sharply — RateX allows users to either hedge exposure or capitalize on rate movements, just like interest-rate traders in traditional finance.

The protocol’s integrations with major Solana DeFi players like Hylo, Kamino, OnRe, Adrastea, and Solayer are accelerating its adoption, making RateX a cornerstone protocol for leveraged yield strategies.

How to Farm the RateX Airdrop

The RateX points system rewards users who actively participate in liquidity provision, leveraged yield trading, and partner integrations.

Points accumulate automatically based on your volume, position size, and duration, with boosts (multipliers) for interacting with partner protocols.

1. Provide Liquidity (LP Farming)

Providing liquidity in synthetic yield pools is the easiest and safest way to start farming RateX points.

- Deposit your yield-bearing tokens (e.g., JitoSOL, Kamino LPs, or Hylo assets).

- Earn APYs up to 50% in certain pools.

- Accumulate RateX points over time.

Pro Tip:

Focus on partner pools — for instance, Hylo pools (hyloSOL or xSOL) — where you earn both RateX Points + Partner Points (like Hylo XP) simultaneously.

This is the most efficient way to farm two airdrops at once.

2. Trade Yield Tokens (YT) with Leverage

This is where RateX truly shines.

If you have experience with Pendle, you’ll find this familiar — but faster and more flexible.

- Use Yield Tokens (YT) to open leveraged positions on expected yield changes.

- Points accumulate faster for larger and longer positions.

For users with smaller capital, leveraged YT trading is the best way to multiply rewards without requiring large deposits.

3. Integrate with Partner Protocols

Engage with partner projects for extra multipliers (4×, 5×, or even 8×).

Examples include:

- Hylo

- Perena

- Solayer

Each integration amplifies your total points, especially when combining RateX actions (liquidity + YT trades) with these partner ecosystems.

4. Track and Compound Your Progress

Your points are automatically tracked by the RateX dashboard.

To compound your rewards:

- Reinvest yields or interest back into partner pools.

- Diversify across multiple yield markets (SOL, JitoSOL, mSOL).

- Maintain your positions for several weeks — time-weighted points reward long-term engagement.

RateX is currently one of the most promising protocols in Solana’s DeFi ecosystem.

Its growing partnerships, cross-chain plans, and robust leverage infrastructure make it a key platform for airdrops and yield strategies alike.

By combining fixed-income farming with leveraged speculation, it offers both stability and upside potential — a rare balance in the world of DeFi.

For airdrop hunters, it’s one of those protocols that’s not just about farming points — it’s about getting early access to a product that’s shaping the future of on-chain yield trading.

🔗Links

RateX: Official Website

RateX Documentation: Docs

Disclaimer

This is not financial advice. If you decide to interact with the mentioned protocols, you do so at your own risk. Airdrop Guild is not responsible for any potential losses resulting from participation. Always do your own research before engaging with blockchain-based projects.