Exponent Protocol is an innovative yield exchange platform built on the Solana blockchain, designed to give users advanced tools for managing yield exposure in decentralized finance (DeFi).

Launched in late 2024, Exponent allows participants to trade yield-bearing assets with variable returns for either fixed yield exposure or leveraged variable yields, enabling investors to structure predictable and optimized strategies.

It stands out for introducing new financial primitives into the Solana ecosystem, including fixed-income products, a yield-specialized Automated Market Maker (AMM) with maturity-based trading mechanics, and an infrastructure that lets users take directional positions on future yield rates within DeFi markets.

Purpose and Context in the Solana Ecosystem

The main goal of Exponent is to solve one of the biggest limitations in traditional DeFi protocols — the unpredictability of variable yields.

In most yield-bearing systems, returns fluctuate depending on lending demand, liquidity, or staking rewards. Exponent addresses this problem by introducing on-chain yield markets that separate predictable income streams from uncertain variable returns.

By operating on Solana, a blockchain known for high speed, low fees, and scalability, Exponent can provide real-time yield trading with minimal transaction costs.

This makes it especially relevant within Solana’s vibrant DeFi environment, which includes yield-bearing assets such as Jito’s VRTs, lending positions, and staking tokens like mSOL or JitoSOL.

Exponent’s architecture allows users to “strip” the yield component from a yield-bearing token — separating it into tradable instruments.

This opens opportunities for hedging against APY volatility, locking fixed income, or leveraging yield exposure for more aggressive strategies.

Core Mechanism – Yield Stripping

At the core of Exponent’s system lies the Yield Stripping Mechanism, which divides a yield-bearing asset into two separate tokens:

- Principal Token (PT):

Represents the locked principal value until maturity.

It trades at a discount initially and gradually increases in value until it equals the original principal (1:1) at maturity — effectively providing a fixed yield. - Yield Token (YT):

Represents the variable income generated by the asset’s yield over time.

Its price reflects the expected future yield until maturity.

By trading YTs, users can speculate on whether yields will rise or fall.

These tokens trade through a time-adaptive AMM that minimizes impermanent loss for liquidity providers who hold positions until maturity.

This mechanism transforms yield into a tradable, composable DeFi primitive.

Liquidity Vaults and Market Functionality

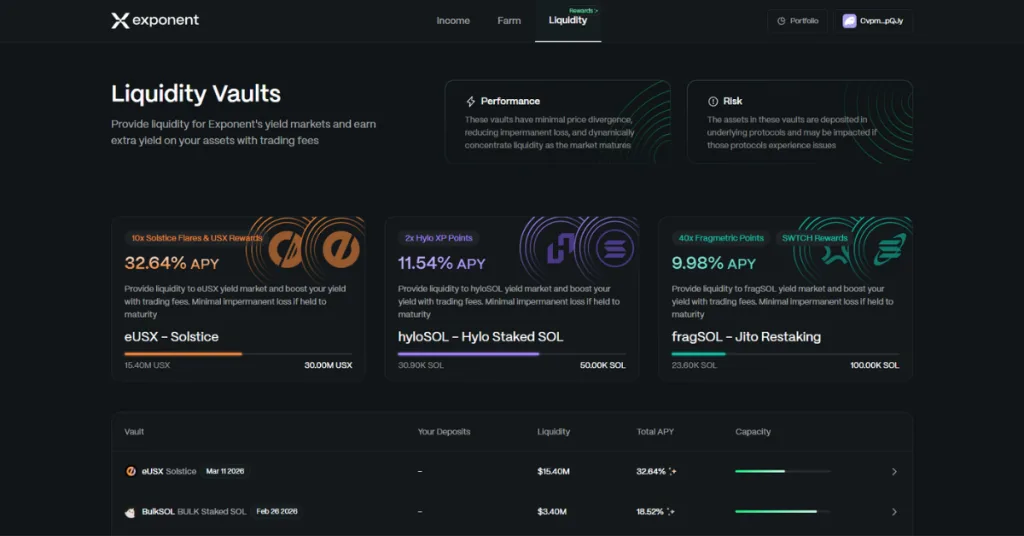

Exponent integrates liquidity vaults that allow users to deposit yield-bearing assets to support AMM trading.

In return, vault depositors earn trading fees and yield rewards.

This architecture not only sustains efficient liquidity, but also lets participants express market opinions — such as betting on yield declines to lock fixed returns or taking leveraged exposure to rising yields.

Main Products and User Strategies

Exponent offers three main products, each tailored to different investor profiles and risk appetites:

1. Income

- Ideal for users seeking stable, predictable returns.

- Converts variable yield into fixed-income exposure through PTs.

- Particularly useful when users expect declining APYs or prefer passive portfolio management.

2. Farm

- Designed for traders aiming to amplify yield exposure.

- Users buy Yield Tokens (YTs) at an implied APY, leveraging their position to benefit from future yield increases.

- Perfect for those who believe the current APY is undervalued.

3. Liquidity

- For users neutral about yield direction.

- Involves supplying liquidity to Exponent’s vaults to earn trading fees and passive yields.

- Since liquidity positions mature, impermanent loss is minimized for LPs who hold until expiration.

Users can access the protocol directly at exponent.finance, deposit yield-bearing tokens, and manage positions through compatible Solana wallets like Phantom, Backpack, or Solflare.

Benefits for Users

- Access to advanced financial tools:

Exponent brings fixed income and leveraged yield trading to DeFi — strategies traditionally available only in institutional markets. - Capital efficiency:

Traders can gain or hedge exposure without selling the underlying assets. - Lower transaction costs:

Solana’s low fees enable efficient short-term yield speculation and rebalancing. - Price discovery for yields:

The creation of secondary markets for yield components improves transparency and efficiency across DeFi. - Diverse opportunities:

Liquidity providers earn passive yield, while traders can hedge or speculate on APY volatility — making Exponent useful for both retail and institutional users.

Risks and Considerations

Like all DeFi protocols, Exponent carries certain risks:

- Smart contract vulnerabilities: Even audited contracts can be exploited, especially with integrations across multiple yield protocols.

- Oracle or network failure: Errors in price feeds or Solana network congestion may cause position mispricing or forced liquidations.

- Underlying asset risk: Since Exponent relies on yield-bearing assets, depegs or protocol failures in those sources could affect returns.

Users should always review audits, official documentation, and protocol updates, and start with smaller amounts before scaling positions.

How to Farm the Exponent Airdrop

As of now, Exponent has not officially confirmed any token or airdrop, but like many Solana DeFi protocols, this silence often precedes a retroactive reward campaign.

Even if an Exponent token never launches, the protocol can still be strategically farmed in parallel with other ongoing campaigns, maximizing returns through multi-farming.

Since Exponent is a liquidity protocol, the main way to farm potential rewards is by providing liquidity in available yield markets.

Doing this earns:

- A percentage of APY from the vault, and

- Potential eligibility for a future airdrop snapshot.

Best Strategy to Maximize Farming

To make the most of your time and liquidity, focus on yield markets connected to projects that already have active airdrop campaigns, such as Solstice and Hylo.

On Exponent, you can find PTs, YTs, and Vaults for these protocols:

- Solstice: PT, YT, and Vault for eUSX

- Hylo: PT, YT, and Vault for xSOL, hyloSOL, and hyloSOL+

By depositing liquidity in these specific markets, you effectively farm multiple airdrops simultaneously — one from Exponent and others from partner protocols like Solstice and Hylo.

This stacked yield approach is one of the main reasons Exponent has gained popularity among serious DeFi users on Solana.

Exponent stands out as one of the most well-designed yield protocols in Solana’s ecosystem.

Its partnerships with projects like Solstice and Hylo, and its ability to combine multiple farming opportunities in one place, make it a must-use protocol for yield farmers seeking both innovation and efficiency.

As yield trading continues to evolve, Exponent is positioning itself not just as another DeFi platform, but as a core financial primitive for Solana’s growing on-chain economy.

🔗Links

Exponent: Official Website

Exponent Documentation: Docs

Disclaimer

This is not financial advice. If you decide to interact with the mentioned protocols, you do so at your own risk. Airdrop Guild is not responsible for any potential losses resulting from participation. Always do your own research before engaging with blockchain-based projects.