Almanak is an innovative DeFi platform powered by artificial intelligence (AI), designed to democratize quantitative trading and allow users to create, optimize, and deploy financial strategies in an accessible and secure way.

Instead of relying on specialized quant teams, Almanak uses AI Swarms, collaborative groups of agents that automate research, optimization, coding, and execution. This makes it possible to turn financial ideas into executable blockchain strategies without advanced programming skills.

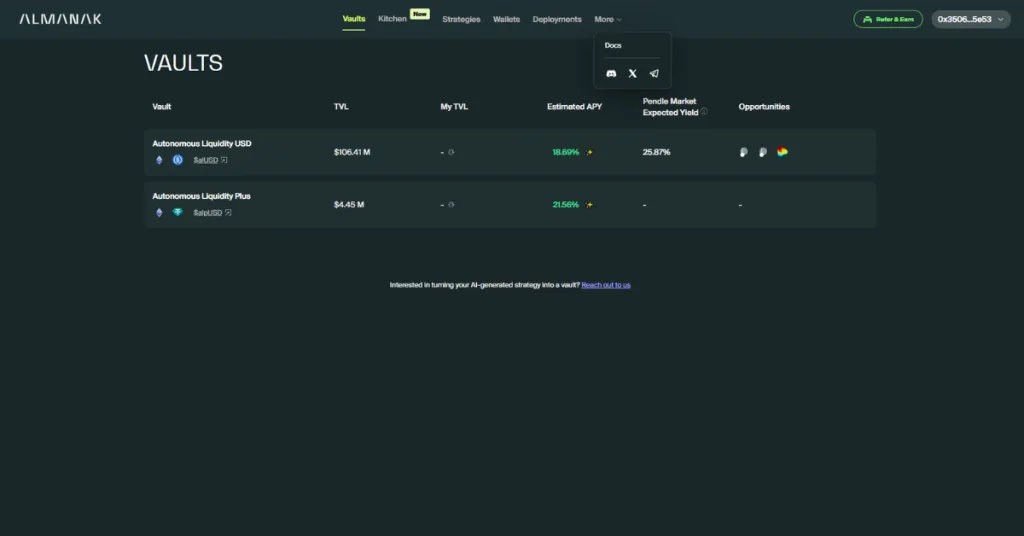

The project has already attracted over 6,000 unique depositors and surpassed $100M in TVL (Total Value Locked) in tokenized strategies created by AI. With $8.45M raised in funding and integrations with protocols like Pendle and Curve, Almanak is positioning itself as an essential piece of the DeFi Lego.

*Advertisement.*

How Does Almanak Work?

The foundation of Almanak lies in its AI Swarm system—about 18 specialized agents grouped into teams:

- Strategy Group: Analyzes on-chain data, identifies opportunities, and drafts strategies.

- Optimization Group: Runs backtests, adjusts parameters, and maximizes capital efficiency.

- Support Group: Developers, auditors, and debuggers ensure secure, verifiable code.

- Execution Group: Deploys strategies in real-time, adapting automatically to volatility.

The output is deterministic and auditable, unlike black-box AI. Strategies are deployed into tokenized vaults (ERC-7540 standard), such as alUSD and alpUSD, which provide liquidity-optimized yield and can be integrated into other DeFi protocols like Curve and Pendle.

All funds remain non-custodial, with permissions managed via Safe + Zodiac, ensuring the AI cannot access private keys.

What Makes Almanak Different?

- Pragmatic AI – Focused on generating verifiable, audit-ready code instead of opaque predictions.

- DeFi-First Design – Tokenized ERC-7540 vaults allow asynchronous operations and seamless composability.

- Institutional Security – Audited, non-custodial infrastructure designed to scale into billions in TVL.

- Accessibility – No-code interface enables anyone, from retail users to DAOs, to build and deploy strategies.

- Automation & Efficiency – Eliminates the need for constant monitoring by reallocating capital automatically across DeFi.

The Potential of Almanak

Almanak is bridging today’s DeFi with the future of AI-driven finance. Its growth potential is immense:

- Market Expansion: Current DeFi inefficiencies can be optimized by AI, unlocking yields in stablecoin pools, cross-chain strategies, and RWAs.

- Innovation Pipeline: Plans include “Almanak Wars” for governance, TEE privacy layers, and advanced institutional vaults.

- Economic Impact: By democratizing quants, Almanak allows retail users and DAOs to access strategies once exclusive to hedge funds.

With TVL already above $100M, the path toward billions in managed assets is clear if adoption continues.

*Advertisement.*

How to Farm the Almanak Airdrop

The Almanak points campaign is designed to reward early adopters and active participants. Points are expected to be converted into $ALM, the native token of Almanak.

- Campaign Timeline:

- Stage 1: July 14 – August 14, 2025 (150,000 points distributed daily).

- Stage 2: September 14 – October 23, 2025 (333,333 points distributed daily).

- How to Earn Points:

- Visit the official Almanak website.

- Choose one of the available vaults: alUSD or alpUSD.

- Deposit funds to start earning both APY and points simultaneously.

- Pendle Strategy for Point Farming:

One of the most asymmetric ways to farm points is by using alUSD Yield Tokens (YT) on Pendle.- Capital can be leveraged over 80x (a $1,000 deposit becomes an $80,000 YT alUSD position).

- This method generates significantly more points but comes with higher risk.

- Unlike vaults that provide positive APY, YT farming can burn capital, so whales often dominate here while small farmers may struggle to compete.

Because the daily point allocation is limited, competition is fierce. For smaller participants, sticking to vaults may be safer, even if returns are lower.

Almanak’s campaign is short but potentially very rewarding. The daily point limit and fixed end date (October 23, 2025) make it predictable, unlike open-ended programs. If the token launch comes with a strong FDV, the airdrop could turn out to be highly profitable for early participants.

For those willing to experiment with AI-powered DeFi strategies, Almanak provides not only an innovative product but also one of the most attractive airdrop opportunities of 2025.

🔗Links

Almanak: Official Website

Pendle: YT alUSD

Almanak Documentation: Docs

Disclaimer

This is not financial advice. If you decide to interact with the mentioned protocols, you do so at your own risk. Airdrop Guild is not responsible for any potential losses resulting from participation. Always do your own research before engaging with blockchain-based projects.