Altura is an innovative multi strategy yield protocol deployed on HyperEVM, part of the Hyperliquid ecosystem. Designed to deliver sustainable, risk adjusted returns, Altura democratizes access to institutional grade investment strategies by allowing users to deposit USDT into a single unified vault. From there, the protocol automatically allocates capital across multiple yield sources, prioritizing efficiency, transparency and long term sustainability.

Unlike speculative DeFi protocols that rely on inflationary token emissions or circular incentive mechanisms, Altura focuses on real economic activity. Its yield is generated from market driven inefficiencies and real cash flow sources, making it more resilient across different market conditions. Built on HyperEVM, a high performance EVM compatible network, Altura benefits from fast execution, robust infrastructure and fully verifiable on chain operations.

*Advertisement.*

How Altura Works on HyperEVM

On HyperEVM, Altura operates as an automated yield management system. Users begin by depositing USDT into the main vault, which acts as the single entry point to the protocol. Once deposited, funds are programmatically allocated across a diversified set of strategies, with automatic rebalancing to maintain optimal risk exposure.

HyperEVM provides the ideal execution environment, supporting complex smart contract logic while maintaining high throughput and low latency. The protocol is market aware but not market dependent, meaning strategies adapt to real conditions without taking directional market bets. All allocations and performance data are transparent and verifiable on chain, allowing users to track how their capital is being deployed at any time.

Yield Strategies Used by Altura

Altura generates yield through three complementary strategic pillars, each designed to capture value in a neutral and sustainable way.

Market Making

Altura provides liquidity on selected venues to capture bid ask spreads. These strategies remain market neutral, generating returns from trading fees rather than price direction.

Funding Rate and Basis Arbitrage

The protocol exploits structural inefficiencies such as funding rate discrepancies and futures basis convergence. These arbitrage strategies are inherently neutral and aim to produce consistent returns regardless of market trends.

Real World Asset Strategies

Altura also allocates capital to yield sources backed by real world economic activity. By incorporating RWA based income, the protocol diversifies beyond purely on chain mechanisms, improving portfolio resilience during different macro environments.

All strategies are selected and managed programmatically, reinforcing Altura’s focus on capital efficiency and yields derived from genuine market inefficiencies.

Vault Mechanics

The vault is the core of the Altura protocol. All USDT deposits are pooled into a single vault, and users receive shares that represent their proportional exposure to the overall strategy set. Capital is automatically distributed across the three yield pillars, with dynamic rebalancing to maintain diversification and manage risk.

This design removes the need for manual strategy management, making Altura accessible even to users without advanced DeFi knowledge. Yield is generated through sustainable mechanisms such as trading fees, hedged funding payments and real asset backed income. Thanks to HyperEVM integration, all vault activity is executed efficiently and remains fully transparent.

Sustainability and Transparency Principles

Altura places strong emphasis on sustainable yield generation. Returns are derived exclusively from economically sound sources such as market driven trading fees, structural arbitrage opportunities and real world backed revenue streams.

The protocol explicitly avoids fragile mechanisms like inflationary token emissions, circular incentives or excessive leverage, which often lead to systemic failures in DeFi during periods of stress.

Transparency is another core pillar. All strategies, allocations and executions are visible on chain, enabling independent verification and building trust. This institutional grade approach positions Altura as a serious yield product rather than a short term speculative protocol.

Risks and Mitigation

Although Altura is designed to reduce risk, it is not risk free. Potential challenges include fluctuations in funding rates, changes in liquidity spreads and variations in real world yield sources, which can affect returns during volatile market conditions.

To mitigate these risks, Altura employs conservative risk management, diversification across independent strategies and hedging where applicable. By avoiding directional speculation and focusing on real yield, the protocol aims to remain resilient across different market cycles.

How to Farm the Altura Airdrop

Altura has officially confirmed a points based airdrop for early adopters and active participants. This airdrop is part of a pre TGE campaign designed to reward users who provide liquidity and engage with the protocol.

The campaign runs for 99 days, starting on January 21, 2026. A total of 750,000 dollars worth of tokens (0.5 percent of total supply) is distributed daily through Merkl based on USDT0 deposits.

However, only 30 percent of the rewards unlock at TGE, with the remaining portion vesting linearly over six months.

*Advertisement.*

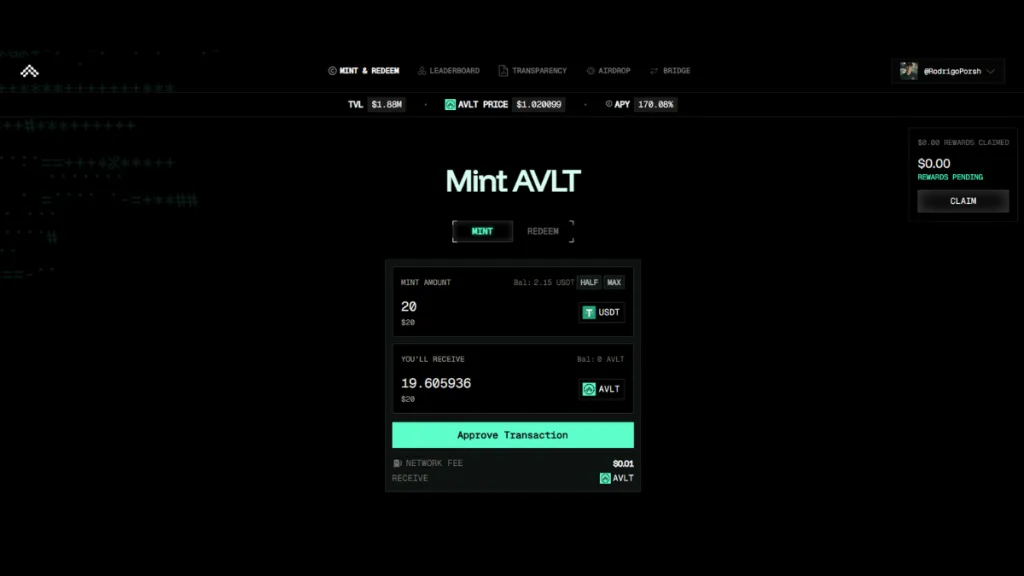

Step by Step: How to Farm Altura

1. Connect an EVM Wallet

Visit the official website at Altura and connect an EVM compatible wallet.

2. Bridge USDT to HyperEVM

If needed, bridge USDT from other networks to HyperEVM using the official Hyperliquid bridge.

3. Deposit USDT0 Into the Vault

Deposit USDT0 into the Altura vault. In return, you receive AVLT shares, representing your share of vault yields and airdrop points.

4. Accumulate Points Automatically

Points are distributed daily and can be tracked through the Merkl dashboard where the campaign is hosted.

By simply holding your deposit in the vault, you earn both base yield and airdrop points simultaneously.

Altura offers a straightforward farming campaign with exposure to stablecoin based yield and a confirmed pre TGE airdrop. With protocol TVL approaching 2 million dollars and growing, it presents an interesting opportunity for users seeking sustainable yield combined with airdrop rewards.

As with any DeFi protocol, risks exist. Always study the project carefully and assess your own risk tolerance before participating.

🔗Links

Altura: Official Website

Altura Documentation: Docs

Disclaimer

This is not financial advice. If you decide to interact with the mentioned protocols, you do so at your own risk. Airdrop Guild is not responsible for any potential losses resulting from participation. Always do your own research before engaging with blockchain based projects.