Cap Money, also known as CAP or Covered Agent Protocol, is a new-generation stablecoin protocol built on the Ethereum blockchain, specifically running on MegaETH, an execution layer designed for ultra-fast and scalable DeFi applications.

Launched on mainnet in August 2025, Cap Money introduces a new category of “Type-3 stablecoin”, positioning itself beyond centralized or DAO-governed models. Its goal is simple but ambitious: to revolutionize yield generation on stablecoins by providing institution-grade returns with on-chain protection against losses — creating a safe, transparent, and automated yield ecosystem.

Purpose and Vision

Cap Money was created to address the main weaknesses of existing stablecoins:

- Type-1 models (like Ethena or Ondo) rely on centralized decision-making, where a single entity allocates funds.

- Type-2 models (like Sky or Maple Finance) use DAO votes, which can be slow or influenced by human error.

Cap introduces a Type-3 model: a self-governing, immutable protocol that enforces strict rules via smart contracts. No human governance, no treasury management — everything is automated and verifiable on-chain.

The long-term vision is to build a universal liquidity marketplace, where institutional capital, DeFi protocols, and even traditional players like BlackRock compete for stablecoin liquidity under the same transparent rules.

As of 2025, non-yield-bearing stablecoins like USDT and USDC dominate about 95% of the $80 billion daily stablecoin volume. Cap aims to expand the yield-bearing segment, currently representing just 8–10% of total stablecoin market cap ($19 billion), which analysts expect to exceed $60 billion by 2028.

How the Cap Money Protocol Works

Cap Money runs entirely on smart contracts, automating every process from minting to yield distribution without human intervention.

It’s built around three main roles: Minters, Operators, and Restakers.

1. Minting and Core Products

cUSD – the base stablecoin

- Minted 1:1 by depositing blue-chip stablecoins such as USDC, USDT, pyUSD, BUIDL, or BENJI.

- Always redeemable 1:1 for reserve assets, ensuring stability and full collateralization.

- Usable across DeFi, payments, and staking.

stcUSD – the yield-bearing version

- Created by staking cUSD.

- Generates passive yield with full downside protection enforced by code.

- Holders automatically receive returns derived from verified operator strategies.

2. Yield Generation Mechanics

Yield comes from a decentralized layer of Operators — specialized institutions like:

- High-frequency trading (HFT) firms,

- Private credit funds,

- Market-making desks, or

- DeFi protocols running automated strategies.

Each Operator must meet a “hurdle rate” (minimum required yield), enforced by smart contracts. They borrow stablecoin capital from the collateral pool and deploy it into yield-generating strategies, such as:

- Funding-rate arbitrage,

- Token farming or liquidity incentives,

- MEV (Miner Extractable Value) strategies,

- Cross-market arbitrage, or

- Real-world asset (TradFi) yield strategies.

The base yield floor is pegged to the Aave stablecoin rate, ensuring a guaranteed minimum return.

Excess yield beyond the hurdle rate is shared between Restakers and Operators as incentives.

For example, one of Cap’s first Operators reportedly manages over $600 billion in assets — a sign that institutional players are already experimenting within this model.

3. Security Layer – The Restakers

Restakers provide security for the protocol by re-staking ETH through EigenLayer or similar frameworks.

They act as decentralized underwriters, insuring the Operators’ leveraged activity and ensuring that any operational losses are absorbed by staked collateral rather than user deposits.

In return, restakers earn premiums from the yield generated.

This structure makes Cap “blow-up-proof”, meaning even if an Operator fails, depositors’ principal remains safe thanks to restaked coverage.

Cap is also the first protocol to implement an Actively Validated Service (AVS) for under-collateralized lending, merging risk management, DeFi, and restaking into one self-sustaining system.

4. Flow Summary

- A user deposits USDC/USDT → mints cUSD.

- The user can then stake cUSD to receive stcUSD.

- Operators borrow from the liquidity pool and deploy strategies exceeding the hurdle rate.

- Restakers back Operators with ETH restaking to secure the system.

- Yield is distributed automatically:

- Base yield → stcUSD holders,

- Premium → Restakers,

- Surplus → Operators.

Everything runs simultaneously and autonomously, without governance votes or human overrides.

Team and Funding

Cap Money is led by Benjamin (CEO), who scaled QiDAO from zero to $400 million TVL, and Weso (CTO), a founding member of Beefy Finance, which peaked above $1 billion TVL.

Funding Overview:

- $8 million seed round (April 2025) – co-led by Franklin Templeton and Kraken Ventures, joined by SCB Limited, Robot Ventures, Anagram, ABCDE, and RockawayX.

- $1.9 million pre-seed (October 2024) and $1.1 million community round (April 2025).

- Total funding: approximately $11 million, primarily used to refine the stablecoin engine and onboard early Operators like SIG, Gauntlet, and Chorus One.

Tokenomics and Governance

There is currently no native governance token (like CAP) announced.

The protocol revolves entirely around cUSD and stcUSD, with supply expanding or contracting dynamically based on deposits.

Governance is minimalist — upgrades occur through audited code deployments rather than human votes, avoiding DAO-related inefficiencies.

Risks to Consider

- Collateral failure: If USDC or USDT were to depeg.

- Smart-contract vulnerabilities: As with any on-chain system.

- Operator misbehavior: Mitigated through restaked coverage.

- Bridge risk: When moving cUSD across chains.

Still, the protocol’s code-enforced downside protection and multi-layered security design make it one of the most resilient stablecoin frameworks to date.

How to Farm the Cap Money Airdrop

Farming revolves around accumulating “Caps” (points) through interaction with the protocol’s products — namely minting and holding cUSD, or staking it to receive stcUSD.

There’s no token yet, but the Caps program is widely expected to precede a future token launch.

Here’s how to farm step by step.

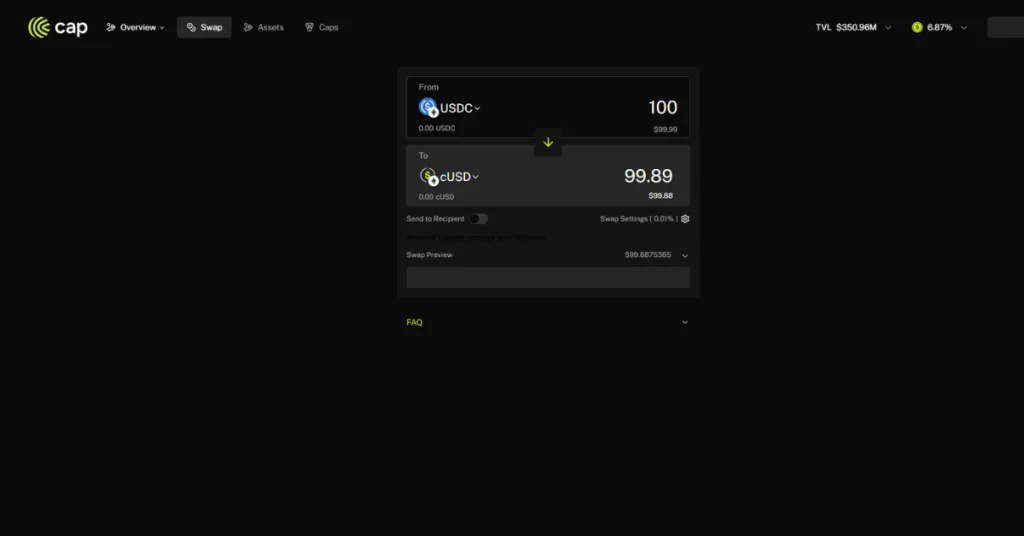

1. Connect Your Wallet and Mint cUSD

- Visit the official Cap Money website.

- Connect an EVM wallet such as Rabby or MetaMask.

- Deposit USDC to mint cUSD on the Ethereum network at a 1:1 ratio.

Each dollar deposited earns 10× Caps per day just for holding cUSD in your wallet — one of the simplest and safest yield-farming setups currently available.

2. Boost Your Multipliers via Pendle

For higher rewards, you can leverage Pendle Finance, which supports Cap Money’s yield tokens.

Main Strategy:

- Purchase YT-cUSD (Yield Tokens) on Pendle.

- YT-cUSD provides up to 20× Caps and lets you leverage your capital by over 30×, making it by far the most efficient farming route.

- This strategy works best for users comfortable with DeFi interactions and Ethereum gas fees.

Pendle effectively tokenizes your yield stream, allowing you to amplify both returns and Caps accumulation without directly staking inside Cap’s interface.

3. Manage Gas and Risks

- Gas fees on Ethereum can add up — try executing transactions during low-fee hours (UTC 03:00–07:00).

- Consider batching operations (mint + stake in one session).

- Always verify official links to avoid phishing attempts.

While there’s a theoretical chance of a temporary cUSD depeg, this risk is minimal.

Because the asset is backed 1:1 by regulated stablecoins and protected by restaked insurance, depegs would likely only occur during extreme market anomalies.

4. Why This Farm Matters

This is a low-risk yield farm in a market full of uncertainty.

With crypto volatility high and liquidity rotating toward stablecoin protocols, allocating a portion of your portfolio to a yield-bearing stablecoin may be a far better defensive strategy than chasing speculative returns.

The combination of:

- Stable-asset farming,

- Downside protection,

- Institutional-grade yield, and

- A strong airdrop narrative

makes Cap Money one of the smartest stablecoin plays of 2025.

🔗Links

Cap Money: Official Website

Cap Money Documentation: Docs

Disclaimer

This is not financial advice. If you decide to interact with the mentioned protocols, you do so at your own risk. Airdrop Guild is not responsible for any potential losses resulting from participation. Always do your own research before engaging with blockchain-based projects.