HyperLend is one of the cornerstone protocols of the HyperEVM, the Ethereum Virtual Machine-compatible layer of the Hyperliquid blockchain. Built as a high-performance decentralized money market, HyperLend acts as the banking infrastructure of HyperEVM, providing users with the ability to lend, borrow, and execute advanced DeFi strategies in a secure and efficient way.

Unlike many lending protocols that face scalability or liquidity issues, HyperLend integrates natively with HyperCore, Hyperliquid’s on-chain orderbook system. This gives it access to deep liquidity, atomic execution, and ultra-low latency, making it far more capital-efficient than traditional lending markets.

With a TVL surpassing $600 million and growing, HyperLend is already the largest lending protocol on HyperEVM, recognized even by Aave governance as a “friendly fork” of its own design. For airdrop hunters and DeFi users, this makes it a critical protocol to watch—and to interact with.

*Advertisement.*

What Is HyperLend?

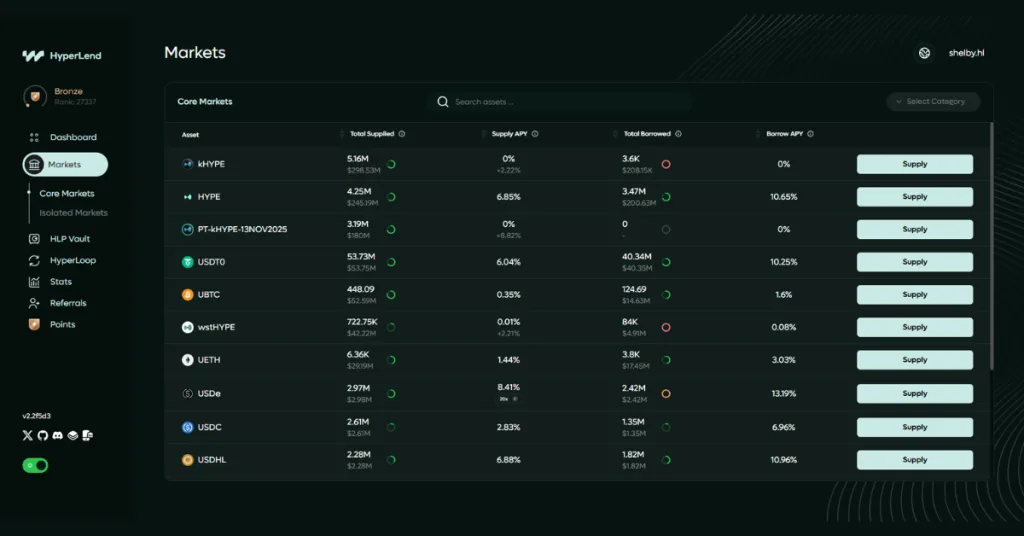

At its core, HyperLend is a decentralized money market where users can:

- Supply assets like HYPE, uBTC, ETH, or stablecoins (USDC, USDT, USDe).

- Earn interest automatically from borrowers.

- Borrow against collateral, unlocking liquidity without selling assets.

- Use borrowed funds to execute strategies such as leveraged yield farming or perpetual trading.

The protocol is designed not only to replicate the success of Aave but also to surpass it in efficiency and performance by leveraging Hyperliquid’s unique architecture.

Goals of the HyperLend Protocol

HyperLend’s mission goes beyond simple borrowing and lending. It aims to:

- Become the dominant lending market on HyperEVM – acting as the foundation of liquidity and composability for the entire ecosystem.

- Drive capital efficiency – by enabling real-time leverage, adaptive interest rates, and seamless integration with HyperCore orderbooks.

- Promote scalability – attracting liquidity to HyperEVM and enabling advanced use cases such as yield vaults, derivatives, and hedging strategies.

- Ensure accessibility and security – with audited contracts, reliable price oracles, and a transparent governance system.

- Fuel ecosystem growth – positioning Hyperliquid as the all-in-one hub for trading and DeFi, combining the efficiency of CEX-style orderbooks with the programmability of DeFi.

HyperLend already generates over $15M in annualized fees for the protocol and its liquidity providers, demonstrating its strong economic engine.

How HyperLend Works

Although HyperLend shares similarities with Aave and Compound, its native integration with HyperEVM and HyperCore sets it apart. Here’s how it works in detail:

1. Lending and Borrowing

- Lending (Supply):

Users deposit assets into liquidity pools. In return, they receive interest-bearing tokens (similar to aTokens in Aave), which accrue yield automatically. - Borrowing:

Borrowers provide collateral and can borrow other assets against it. The borrowing power is capped by Loan-to-Value (LTV) ratios, typically 70–80% depending on the asset. - Dynamic Interest Rates:

Instead of fixed rates, HyperLend uses algorithmic, real-time rate adjustments. As demand for borrowing increases, borrowing rates rise and supply rates adjust, ensuring balance in the market.

2. Native HyperCore Integration

This is where HyperLend truly shines. By integrating with HyperCore, the on-chain orderbook layer, HyperLend achieves unmatched execution speed and accuracy.

- Read Precompiles:

Smart contracts can directly read prices, spot balances, perp positions, and vault equity from HyperCore. This ensures liquidation calculations are precise and real-time. - Write System Contracts:

During liquidations, HyperLend can directly place orders into HyperCore’s orderbook, swapping collateral for stablecoins in a single atomic transaction. This makes liquidations faster, cheaper, and more efficient than on traditional DeFi platforms. - Unified Chain:

Everything runs under HyperBFT consensus, eliminating delays or risks associated with bridging between chains. For example, a user can deposit HYPE in HyperEVM and immediately use it as collateral in HyperCore perp trades.

3. Advanced Features and Strategies

HyperLend is not just a lending protocol; it’s an innovation hub for DeFi strategies:

- Real-Time Leverage: Instantly borrow assets to create leveraged positions, such as yield farming loops.

- HyperLoop Tool: A one-click leverage looping system (e.g., deposit kHYPE → borrow wHYPE → redeposit → repeat). Normally tedious, now automated.

- HLP Vaults: Liquidity provider vaults that generate both trading fees and yield tokens compatible with DeFi.

- Efficient Liquidations: Health factors are constantly monitored, and liquidations execute instantly through HyperCore, minimizing risks for lenders.

- Unified Trading Account (UTA): Enables spot collateral to back perp trades directly, combining CEX-style efficiency with DeFi programmability.

4. Security and Governance

- Audits: Conducted by firms like Zokyo and BlockAnalitica.

- Oracles: HyperLend integrates Chainlink and Pyth for reliable, tamper-proof pricing.

- Governance: As a fork of Aave, it uses a governance token and proposal system, focusing on expanding isolated markets with controlled risk.

How to Farm the HyperLend Airdrop

HyperLend currently operates a points program, rewarding users based on their activity. Points are distributed every Wednesday, and users can climb through tiers based on participation.

Ways to Earn Points:

- Lending & Borrowing:

- Deposit assets like HYPE, ETH, BTC, USDC, or USDT.

- Earn supply APY while simultaneously gaining points.

- Borrow against collateral to amplify strategies—but be mindful of liquidation risks.

- HyperLoop Strategy:

- Use HyperLend’s one-click HyperLoop tool to create leveraged loops.

- Example: lend kHYPE → borrow wHYPE → lend again.

- This compounds both yields and points but comes with higher risk.

- HLP Vault Deposits:

- Deposit into HLP vaults (e.g., wHLP) to earn around 5% APY plus points.

- Vaults combine trading fees with protocol incentives for steady returns.

- Token Exposure Choices:

- Risk-tolerant users can farm volatile assets like HYPE, BTC, or ETH.

- Risk-averse users can farm with stablecoins like USDC or USDT for safer but lower yields.

By combining lending, borrowing, and vault deposits, users can maximize both real yield and points accumulation, which may later translate into token rewards.

Final Thoughts

HyperLend is not just another lending protocol—it is the financial backbone of HyperEVM. Its integration with HyperCore, high TVL, and innovative tools like HyperLoop and HLP Vaults make it an essential protocol for both traders and farmers.

For airdrop hunters, HyperLend offers one of the strongest cases for participation in the Hyperliquid ecosystem. With TVL already close to $1B, daily fees in the millions, and a robust points system in place, HyperLend stands out as a protocol with both short-term farming opportunities and long-term sustainability.

Whether you’re lending stablecoins for passive yield, looping positions for maximum leverage, or simply holding collateral to back perp trades, interacting with HyperLend is almost a requirement for anyone farming on HyperEVM.

🔗Links

HyperLend: Official Website

HyperLend Documentation: Docs

Disclaimer

This is not financial advice. If you decide to interact with the mentioned protocols, you do so at your own risk. Airdrop Guild is not responsible for any potential losses resulting from participation. Always do your own research before engaging with blockchain-based projects.