HypurrFi is a decentralized finance (DeFi) protocol built on HyperEVM, the Ethereum-compatible execution layer of the Hyperliquid blockchain. Launched in 2025, HypurrFi is more than just another lending platform—it acts as a full on-chain debt service infrastructure, offering lending, borrowing, refinancing, and debt optimization tools.

The protocol focuses on leveraged yield opportunities while maintaining stability through the use of its native USDXL stablecoin, which is partially backed by real-world assets (RWAs) such as U.S. Treasuries. This combination of advanced strategies, institutional-friendly design, and community-driven rewards makes HypurrFi one of the most talked-about protocols on HyperEVM.

Its airdrop potential comes from an ongoing points system, rewarding active participants for lending, borrowing, liquidity provision, and other activities. For airdrop hunters, HypurrFi represents one of the most promising opportunities in the ecosystem.

*Advertisement.*

What Is HypurrFi?

At its core, HypurrFi is a non-custodial, smart contract-based lending platform. It draws inspiration from proven models like Aave v3 (for pooled markets) and Fraxlend (for isolated markets), while optimizing for the speed and performance of HyperEVM.

Through HypurrFi, users can:

- Deposit assets (e.g., HYPE, stHYPE, USDT, USDC, USDe, feUSD, USDHL, UBTC, UETH, USOL).

- Earn variable or fixed yields from borrowers.

- Borrow against collateral, sometimes with up to 5x leverage.

- Loop strategies recursively to maximize yield.

The protocol currently manages between $100M–$200M in TVL, with nearly 90% of deposits re-lent in recursive loops. This highlights HypurrFi’s role as a credit engine for the HyperEVM economy.

How HypurrFi Works

1. Lending and Borrowing

- Lending: Users supply assets to liquidity pools, earning yield based on utilization and interest models.

- Borrowing: Overcollateralized borrowing allows users to mint stablecoins or borrow assets to increase exposure.

- Health Factor: Monitored in real time by HypurrFi’s risk engine. If it falls below safe levels, liquidations occur automatically.

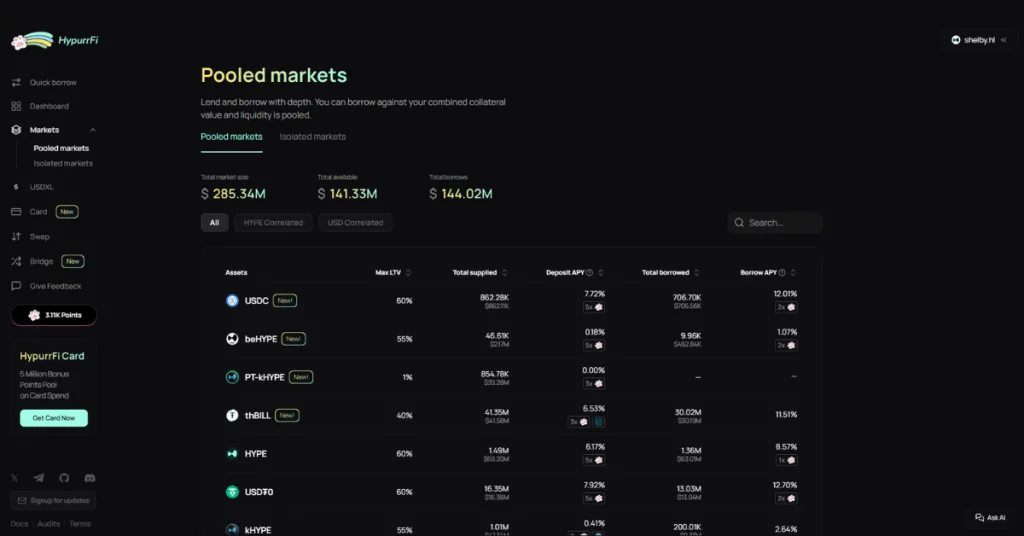

2. Market Structures

- Pooled Markets: Shared risk pools for mainstream assets like HYPE, USDC, USDT.

- Isolated Markets: Dedicated pools for riskier assets (e.g., wrapped stablecoins like USDT0).

- This dual structure provides flexibility, balancing safety with opportunity.

3. Leverage and Loops

- Users can loop positions by depositing collateral, borrowing against it, and redepositing.

- Example: Deposit HYPE → borrow USDXL → buy more HYPE → redeposit → repeat.

- Loops can amplify yields significantly (18–26% APY reported), but come with liquidation risks.

4. Real-Time Risk Management

- HypurrFi leverages HyperCore’s sub-second oracles, refreshing positions every 200ms.

- This reduces the risk of cascading liquidations compared to protocols like Aave on slower chains.

*Advertisement.*

The USDXL Stablecoin

One of HypurrFi’s most important innovations is USDXL, a native stablecoin of HyperEVM.

How USDXL Works

- Overcollateralized: Minted against blue-chip assets like HYPE, BTC, and ETH.

- RWA Backing: A portion of its reserves comes from U.S. Treasury bonds, adding real-world stability.

- Peg Stability: Designed to maintain a 1:1 peg with USD.

Utility of USDXL

- Cheap Borrowing: Users can borrow USDXL against deposits for low-interest liquidity.

- Staking in Vaults: Lock USDXL in vaults to earn extra yield (up to 2x point boosts).

- Liquidity Provision: Provide liquidity in pools like HYPE/USDXL for up to 10x points.

- DeFi Integrations: Widely composable with other HyperEVM protocols.

By combining crypto-native collateral with RWAs, USDXL stands out as a stable and scalable building block for the HyperEVM economy.

Advanced Strategies and Tools

Looping for Yield Amplification

Recursive loops allow users to maximize APY, though they require careful monitoring of the health factor to avoid liquidation.

pawSwap (Auction-Based Order Flow)

HypurrFi integrates pawSwap, which optimizes liquidations and swaps by accessing HyperCore’s orderbook directly.

Swype Card (with BrahmaFi)

- A crypto payment card linked directly to HypurrFi positions.

- Accepted by 100M+ merchants worldwide.

- Rewards users with up to 50,000 points for spending activity.

Vaults and Partner Strategies

- Specialized vaults for high-yield farming.

- Integrations with protocols like HyperBeat and Valantis for layered strategies.

Hyperscan for Developers

- A dev environment enabling integrations on HyperEVM.

- Supports institutional capital deployment with compliance paths.

Why HypurrFi Stands Out in HyperEVM

- Deep HyperCore Integration

- Sub-second oracles and real-time execution reduce liquidation risks.

- Far more efficient than Ethereum-based lending markets.

- Debt Infrastructure, Not Just Lending

- Includes refinancing tools, collateral swaps, and optimization strategies.

- Attractive to institutions as well as retail farmers.

- Stability via RWAs

- USDXL’s partial backing by Treasuries mitigates volatility.

- Bridges traditional finance into DeFi.

- Accelerated Yields

- Recursive loops allow APYs in the 18–26% range.

- Combined with point farming, HypurrFi becomes a yield hub.

- Robust Community Incentives

- Ongoing points program with weekly rewards.

- Hot Streak bonuses for consistent activity.

- Referral codes with 5% boosts.

- Risk Mitigation

- Segregated USDXL reserves absorb shocks.

- Designed to prevent systemic collapse like Terra/Luna in 2022.

*Advertisement.*

How to Farm the HypurrFi Airdrop

The HypurrFi points program, known as HypurrFi Points (HP), is the main path for potential airdrop eligibility.

Program Structure

- Seasons: Divided into campaigns. Season 1 ended in September 2025. Season Mew (Season 2) is ongoing.

- Points Supply: 100M HP distributed weekly in Season 2 (up from ~1M in Season 1).

- Snapshots: Daily and weekly snapshots track user engagement.

Ways to Earn Points

- Lending & Borrowing

- Deposit assets like HYPE, USDC, USDT, or USDXL.

- Looping strategies earn significantly more points due to liquidity recirculation.

- Liquidity Provision (LPs)

- Add liquidity to pools like HYPE/USDXL or BUDDY/HYPE.

- Boosted pools offer up to 10x multipliers.

- Minting USDXL

- Minting the stablecoin itself earns points, especially when combined with recursive strategies.

- Boost Multipliers

- Certain markets (e.g., USDC, USDHL) grant 5x multipliers.

- Hot Streaks reward consistent weekly activity (+10% bonus for 10 weeks).

- Swype Card Spending

- Weekly allocation of 5M points for Swype Card users.

- Tracked retroactively since card launch.

- Partner Vaults

- Collaborations with HyperBeat, Valantis, and Kinetiq enable multi-protocol farming, where points are stacked across integrations.

Final Thoughts

HypurrFi has quickly become one of the most important protocols in the HyperEVM ecosystem, standing as the third-largest lending protocol on the network. With its innovative USDXL stablecoin, recursive yield loops, and deep integration with HyperCore, HypurrFi offers both sustainability and high rewards.

For airdrop hunters, HypurrFi’s points program is a golden opportunity. While nothing has been officially confirmed, the scale of incentives and speculation around a potential token make HypurrFi one of the most attractive protocols to farm right now.

Beyond speculation, HypurrFi also provides genuine value: reliable lending markets, stablecoin infrastructure, and integrations that bring real-world stability into DeFi. This positions it as a protocol worth engaging with—whether you are an NFT trader, a leveraged yield farmer, or simply a DeFi participant looking for safe, consistent returns.

🔗Links

HypurrFi: Official Website

HypurrFi Documentation: Docs

Disclaimer

This is not financial advice. If you decide to interact with the mentioned protocols, you do so at your own risk. Airdrop Guild is not responsible for any potential losses resulting from participation. Always do your own research before engaging with blockchain-based projects.