LiquidSwap is a decentralized exchange (DEX) aggregator built specifically for the HyperEVM, the Ethereum-compatible layer of the Hyperliquid blockchain. Instead of hosting its own liquidity pools, LiquidSwap aggregates liquidity from multiple DEXs within HyperEVM, enabling users to trade tokens with better exchange rates, lower slippage, and higher efficiency.

Developed by Liquid Labs, LiquidSwap is closely tied to the Hyperliquid ecosystem, which combines an on-chain order book system (HyperCore) with EVM programmability (HyperEVM). This makes LiquidSwap a vital tool for traders navigating fragmented liquidity across different DEXs.

The project is also integrated with LiquidLaunch, a fair-launch token launchpad for ERC-20 tokens on HyperEVM, ensuring that newly launched tokens gain immediate liquidity and can be traded directly through the aggregator.

Its native token, $LIQD, serves as a utility asset for governance, incentives, and potentially staking or farming opportunities across the Liquid Labs ecosystem.

*Advertisement.*

How LiquidSwap Works

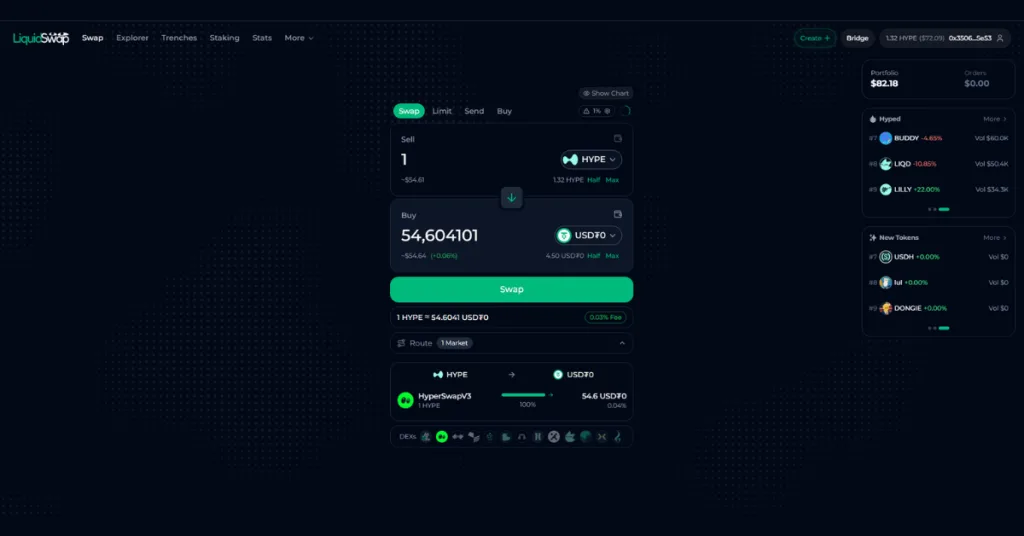

LiquidSwap functions as a liquidity aggregator and routing engine, similar to protocols like 1inch or Matcha on other blockchains, but optimized for Hyperliquid’s low-latency, high-performance environment.

Liquidity Aggregation

- LiquidSwap combines liquidity from numerous HyperEVM DEXs, including KittenSwap (V3 and V4), HyperSwap, Laminar, Valantis, Hybra Finance, Gliquid, Ramses Exchange, HyperCat, Project X, HyperBrick, HX Finance, and UpheavalV3.

- By aggregating these pools, it creates a “virtual super pool,” offering deeper liquidity and better pricing than a single DEX could provide.

Smart Routing

- When users initiate a swap, LiquidSwap’s algorithms split transactions across multiple pools or DEXs (multi-hop routing).

- The routing system optimizes trades in real time, minimizing slippage and avoiding inefficient paths.

- Fees are competitive (typically 0.01%–0.1%) depending on integration.

- Smart routing also reduces the risk of frontrunning or MEV (Miner Extractable Value).

Integrations and Features

- API for Developers: LiquidSwap offers a developer API that allows third parties to integrate swaps into apps or bots. Developers can retain 97.5% of trading fees, earning up to 1% per transaction.

- LiquidLaunch Integration: Tokens launched via LiquidLaunch are automatically routed into liquidity pools and tradable on LiquidSwap from day one.

- Mobile Trading: Integrated with apps like Mercury for trading on the go.

- Cross-Protocol Partnerships: Works with protocols like HyperBeat MasterSwap, enabling swaps between HyperCore and HyperEVM.

- Bridges: Supports fund bridging into HyperEVM from Ethereum (via Symbiosis) or Solana (via Bungee).

- Security Features: Token approval revocation is built into the platform, helping reduce exploit risks.

How to Farm the LiquidSwap Airdrop

While no official LiquidSwap airdrop has been confirmed, interacting with the protocol provides several potential benefits:

- Swapping Tokens:

- Execute token swaps using LiquidSwap.

- Each swap may qualify you not only for a future LiquidSwap airdrop but also for incentives from the underlying DEX that processed the trade.

- Staking $LIQD:

- Users can stake the native $LIQD token, which may play a role in governance and could qualify for future rewards.

- Exploring Trenches:

- LiquidSwap features a tool called “Trenches” for creating or buying newly issued tokens.

- Caution: Interacting with unverified tokens carries significant risk, as many new launches may lack credibility.

By using LiquidSwap, users effectively farm multiple protocols at once—earning potential exposure to LiquidSwap rewards, DEX-specific incentives, and even future rounds of Hyperliquid ecosystem airdrops.

Final Thoughts

LiquidSwap is becoming an essential part of the HyperEVM trading infrastructure, solving the liquidity fragmentation problem by acting as a routing layer across multiple DEXs. Its integration with LiquidLaunch and ability to aggregate liquidity from over a dozen protocols make it a powerful tool for traders and builders alike.

For airdrop hunters, LiquidSwap offers a unique advantage: simply by making swaps, you may qualify for future LiquidSwap rewards, while also farming other DEX incentives simultaneously. Combined with its potential role in Hyperliquid’s broader ecosystem rewards, it stands out as one of the most efficient and multi-layered farming opportunities on HyperEVM today.

🔗Links

LiquidSwap: Official Website

LiquidSwap Documentation: Docs

Disclaimer

This is not financial advice. If you decide to interact with the mentioned protocols, you do so at your own risk. Airdrop Guild is not responsible for any potential losses resulting from participation. Always do your own research before engaging with blockchain-based projects.